Are you tired of feeling like your credit score is stuck in neutral? You’re not alone! In a world where financial freedom often hinges on that elusive three-digit number, the pressure to boost your credit can feel overwhelming. But fear not—SharkShop.biz is here to revolutionize your journey to a healthier credit score! With our innovative strategies and expert insights, you’ll discover how to elevate your score faster than ever before.

Say goodbye to tedious waiting periods and hello to smart solutions that fit seamlessly into your life. Dive into our approach and unlock the doors to better financing options, lower interest rates, and peace of mind—all while saving time. Let’s get started on making those numbers work for you!

Introduction to the Importance of Credit Score

Your credit score is more than just a number; it’s a vital part of your financial identity. Whether you’re applying for a mortgage, leasing an apartment, or even landing that dream job, your credit score plays a crucial role in the decisions others make about you. A higher score opens doors to better interest rates and loan approvals, while a lower one can feel like an anchor weighing you down.

But what if we told you that improving your credit score doesn’t have to be complicated or time-consuming? At SharkShop.biz, we’re committed to demystifying the process and helping you navigate it with confidence. With our approach, raising your credit score can be achieved in less time than you’d think. Let’s dive into how we can help turn your financial dreams into reality!

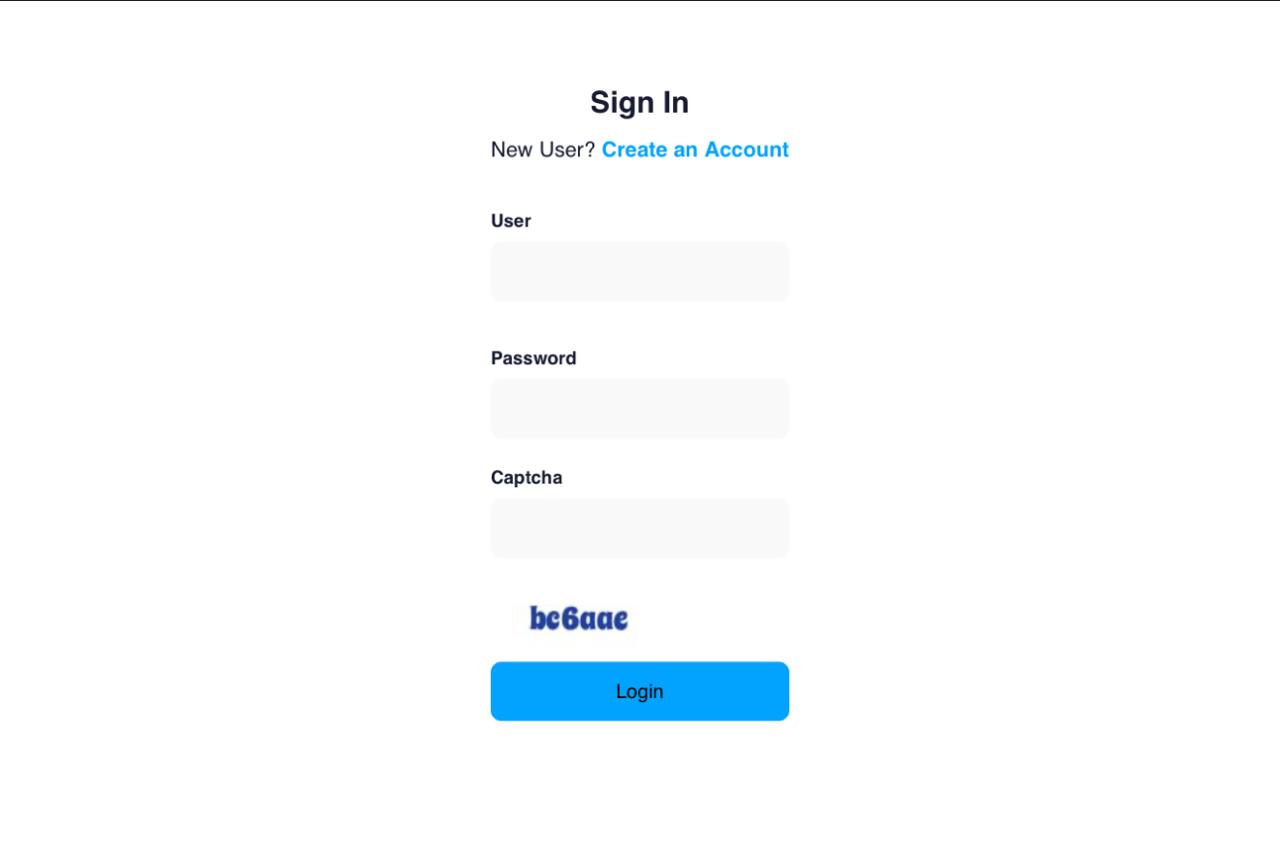

A Screenshot of Sharkshop (Sharkshop.biz) login page

Understanding How Credit Scores are Calculated

Credit scores might seem mysterious, but they are based on clear factors. Lenders use a formula to assess your creditworthiness. The most common model is FICO, which includes five key components.

Payment history accounts for 35% of your score. Timely payments boost your standing, while late ones drag it down.

Next comes credit utilization, making up 30%. This ratio compares your current debt load to available credit limits. Keeping it below 30% is ideal.

Length of credit history contributes 15%. A longer track record shows stability and reliability.

New credit inquiries add another layer at 10%. Too many applications in a short span can raise red flags for lenders.

Lastly, the types of credit you have – revolving accounts and installment loans – make up the final 10%. A mix demonstrates that you can manage various forms of debt responsibly.

Common Misconceptions about Raising Credit Scores

Many people believe that closing old credit accounts will boost their score. This is a common misconception. In reality, keeping these accounts open can benefit your credit history and reduce your utilization ratio.

Another myth is that checking your own credit report harms your score. While hard inquiries from lenders do affect it, soft inquiries—like checking your own scores—have no negative impact at all.

Some assume paying off debts immediately means instant improvement in their SharkShop score. However, the timing of reporting matters more than the act itself. It often takes time for updates to reflect on reports.

Lastly, there’s a belief that you need perfect credit to apply for loans or cards. Many lenders consider various factors beyond just the number; they look at overall financial behavior too. Understanding these misconceptions helps pave a clearer path toward improving one’s credit health.

SharkShop’s Method for Improving Your Credit Score

SharkShop takes a personalized approach to improving your credit score. It begins with an in-depth evaluation of your current financial situation, ensuring that you understand where you stand.

Next, SharkShop helps identify specific areas for improvement. This could involve addressing high credit utilization or late payments. Understanding these factors is vital for growth.

Once you’ve pinpointed the weaknesses, creating a tailored plan of action becomes essential. SharkShop works alongside you to set realistic and achievable goals.

Good credit habits are key to long-term success. Implementing practices like timely bill payments and maintaining low balances on credit cards can make a significant impact.

Lastly, monitoring progress is crucial. By regularly checking scores and adjusting strategies as needed, you’ll stay on track toward achieving your desired credit level without unnecessary delays or stress.

– Step 1: Evaluate Your Current Financial Situation

Understanding where you stand financially is crucial. Start by gathering all your financial documents, including bank statements and credit reports. This gives you a clear snapshot of your current situation.

Next, take note of any outstanding debts and their interest rates. Are there loans or credit cards that are particularly burdensome? Identifying these can help prioritize what needs immediate attention.

Additionally, assess your income sources. How stable is your job? Do you have any side gigs? Knowing the ins and outs of your earnings allows for better budgeting in the long run.

Lastly, keep track of monthly expenses. Break them down into essentials versus non-essentials. This insight will not only clarify spending habits but also highlight areas where adjustments could be made to boost savings or pay off debt faster. The clearer the picture, the easier it becomes to strategize effectively moving forward with SharkShop’s methods for raising your credit score.

– Step 2: Identify Areas for Improvement

To effectively raise your credit score, identifying areas for improvement is crucial. Start by reviewing your credit report thoroughly. Look out for any inaccuracies or outdated information that could be dragging down your score.

Next, assess your credit utilization ratio. This metric reflects how much of your available credit you’re using. Ideally, you should aim to keep this below 30%. If it’s higher, consider paying down high balances first.

Pay attention to payment history as well. Late payments can severely impact your score over time. Make a note of any missed payments and strategize on how to avoid them in the future.

Lastly, evaluate the types of credit accounts you have open. A healthy mix—such as revolving credit cards and installment loans—can boost your score significantly if managed responsibly. Focusing on these key areas will set the stage for a stronger financial profile moving forward.

– Step 3: Create a Plan of Action

Creating a solid plan of action is your roadmap to a better credit score. This step involves setting realistic goals based on the areas you identified for improvement.

Start by breaking your objectives into smaller, manageable tasks. For instance, if you need to pay down debt, outline how much you can pay each month and prioritize high-interest accounts first.

Consider automating payments to ensure you’re never late. Timeliness plays a huge role in your credit score.

Next, incorporate positive behaviors like keeping credit utilization low. Aim for using only 30% or less of your available credit limit.

Finally, write everything down. A visual representation of your goals can keep you motivated and accountable as you work through this journey with SharkShop’s guidance.

– Step 4: Implement Good Credit Habits

Building good credit habits is essential for long-term financial health. Start by paying your bills on time, every time. Late payments can severely impact your score.

Next, keep your credit utilization low. Aim to use no more than 30% of your available credit limit. This shows lenders that you’re responsible and not overly reliant on borrowed funds.

Consider setting up automatic payments or reminders for due dates. Life gets busy, and it’s easy to forget a payment amidst the chaos.

Additionally, avoid applying for multiple new accounts at once.SharkShop login Each application results in a hard inquiry that can temporarily lower your score.

Lastly, regularly review your credit report for errors or inaccuracies. Disputing incorrect information helps maintain an accurate reflection of your financial behavior and boosts credibility with lenders.

– Step 5: Monitor Your Progress and Adjust as Needed

Monitoring your progress is crucial in the journey to improve your credit score. Regularly check your credit report and scores from reputable sources. This will help you stay informed about how your actions are influencing your financial standing.

Be proactive in identifying changes, whether positive or negative. If certain strategies aren’t yielding results, don’t hesitate to pivot. Adjustments might include revisiting payment plans or focusing on different areas that need attention.

Consider setting up alerts with SharkShop for any fluctuations in your score. These notifications can serve as a reminder to review current habits and make necessary tweaks.

Remember, raising a credit score isn’t always linear. Embrace flexibility and be ready to adapt based on what you learn along the way. Each step brings new insights into managing credit effectively, contributing to long-term success.

Frequently Asked Questions about Credit Scores and SharkShop’s Approach

Many people have questions about credit scores and how SharkShop can help. One common query is, “What factors influence my credit score?” Several elements play a role, including payment history, credit utilization, and the length of your credit history.

Another frequent question is regarding the timeline for seeing improvements. SharkShop’s tailored approach can yield noticeable changes in as little as three months. However, individual results may vary based on unique financial situations.

People also wonder if using SharkShop’s services will hurt their score. The answer is no—our methods focus on positive practices that enhance your standing rather than jeopardizing it.

Lastly, clients often ask about ongoing support after their scores improve. SharkShop provides continuous resources to help maintain good habits long-term. This commitment ensures you stay informed and empowered to make savvy financial choices.

Real-Life Success Stories from Customers who Raised Their Scores with SharkShop

At SharkShop cc, we witness incredible transformations every day. Take Jessica, for example. Struggling with a low credit score due to missed payments, she felt trapped. After joining SharkShop, she learned how to manage her debts better and made timely payments. Within just six months, her score jumped by 120 points.

Then there’s Marcus. He had no idea where to start after facing financial setbacks from unexpected medical bills. With personalized guidance from SharkShop’s experts, he identified key areas needing attention and took actionable steps that reshaped his financial future—resulting in an impressive increase of over 90 points within a few months.

These stories highlight the power of informed choices and consistent effort. Each success is unique but connected through one common thread: determination combined with effective strategies provided by SharkShop’s dedicated team.

Conclusion and Final Thoughts on Taking

Raising your credit score is a journey that can significantly impact your financial future. Understanding the importance of your credit score and how it’s calculated lays the groundwork for making informed decisions. By debunking common misconceptions, you can approach this task with clarity.

SharkShop.biz offers a structured method to tackle credit improvement effectively. The steps from evaluating your current situation to implementing good habits create a roadmap tailored to individual needs. It’s not just about quick fixes; it’s about sustainable change.

Regularly monitoring progress ensures you’re on track and allows for adjustments along the way. With SharkShop’s guidance, many have found success in elevating their scores rapidly and efficiently.

For those eager to enhance their financial standing, remember that small actions can lead to significant results over time. Utilize tips and tricks designed specifically for quicker improvements, engage with FAQs for additional insights, and draw inspiration from real-life success stories shared by satisfied customers.

Taking charge of your credit score doesn’t have to be daunting or overwhelming. Embrace the process as an opportunity for growth—both financially and personally—and discover how SharkShop can support you every step of the way.