In today’s unpredictable world, insurance serves as a crucial safety net, providing financial protection against unforeseen events. From natural disasters to accidents and theft, insurance policies offer coverage for a wide range of risks. In this article, we’ll explore the most common types of insurance claims that individuals and businesses encounter. Understanding these common scenarios can help policyholders make informed decisions when selecting insurance coverage and navigating the claims process efficiently. Whether it’s auto accidents, property damage, or medical emergencies, being prepared for common insurance claims is essential for peace…

Search Results for: insurance

Best Life Insurance for Seniors Over 60 in Canada

Best Life Insurance for Seniors Over 60 in Canada Introduction As seniors in Canada navigate the golden years of their lives, ensuring financial stability and security becomes a top priority. Amidst the myriad of options available, life insurance emerges as a crucial tool for safeguarding the financial well-being of seniors and their loved ones. In this article, we delve into the realm of life insurance, exploring its significance, types, and utilization, particularly focusing on the best options available for Best life insurance for seniors in Canada. What are the Life…

A Step-By-Step Process for Securing Home Inspector Insurance

Buying a home is likely one of the biggest financial decisions you’ll make in your life. Before signing on the dotted line, most buyers wisely opt to have a home inspection performed to evaluate the condition of the property and uncover any potential problems or safety issues. As a home inspector, providing this important service comes with immense responsibility. While home inspections aim to provide an objective analysis, they are not foolproof. Even the most experienced and competent home inspector can occasionally miss something or make an inaccurate assessment. Minor…

Permanent Life Insurance in Winnipeg: Everything You Need to Know

Introduction Pеrmanеnt lifе insurancе is a crucial financial tool for rеsidеnts of Winnipеg, offеring long-tеrm protеction and potential bеnеfits that еxtеnd bеyond mеrе covеragе. In this thriving Canadian city, individuals and families arе incrеasingly rеcognizing thе valuе of pеrmanеnt lifе insurancе as a mеans to sеcurе thеir financial futurеs. Unlikе tеrm lifе insurancе, which providеs covеragе for a spеcifiеd pеriod, pеrmanеnt lifе insurancе is dеsignеd to last a lifеtimе, providing a dеath bеnеfit to bеnеficiariеs whilе also accumulating cash valuе ovеr timе. In Winnipеg, whеrе financial stability and sеcurity arе…

How To Choose The Best Insurance Adjuster St.Petersburg?

You have come to the right place to know how to choose the best insurance adjuster St. Petersburg. Determining the damages caused by natural and artificial disasters needs a lot of investigation skills and experience. If you are hit by a hurricane, flood, fire other disaster, it could be challenging; you may need more expertise to claim the insurance amount. Most people in such situations make mistakes from filling out the claim application to the entire process, enabling the insurance company to deny or give only part compensation. It is…

Motorhome Insurance and Quad Bike Insurance Quotes

Motorhome insurance and quad bike insurance quotes are crucial because embarking on a journey with your motorhome or quad bike is an exhilarating experience, offering the freedom to explore the open road. However, to truly enjoy these adventures, it’s crucial to safeguard your vehicles with the right insurance coverage. In this comprehensive guide, we’ll delve into the nuances of Motorhome Insurance and explore the world of Quad Bike Insurance quotes to ensure you’re well-prepared for the road ahead. Motorhome Insurance: Protecting Your Home on Wheels A motorhome is more than…

If I purchase top-up health insurance, what is the coverage of my policy?

In our fast-paced modern world, looking out for your well-being takes centre stage. One effective avenue for this is securing health insurance, often referred to as medical insurance. To make decisions that truly empower you, gaining a firm grasp of the nuances of medical insurance, including determining the best health insurance policy and understanding the concept of top-up health insurance, is absolutely pivotal. This article is a deep dive into the extent of coverage that top-up health insurance plans offer, with the ultimate aim of providing you with the knowledge…

Get Justice by Hiring a Lawyer for Resolving Your Insurance Dispute

If you’re involved in an insurance dispute, hiring a lawyer is extremely important. You are setting yourself up for more trouble if you do not hire a lawyer right away. There are many advantages associated with hiring a lawyer to resolve disputas de seguros in Sarasota. Read the entire article to learn more. The primary advantage of hiring a lawyer for your insurance dispute is their experience and expertise. Having handled similar insurance disputes over the years, they would know how to handle your situation and get you your claim.…

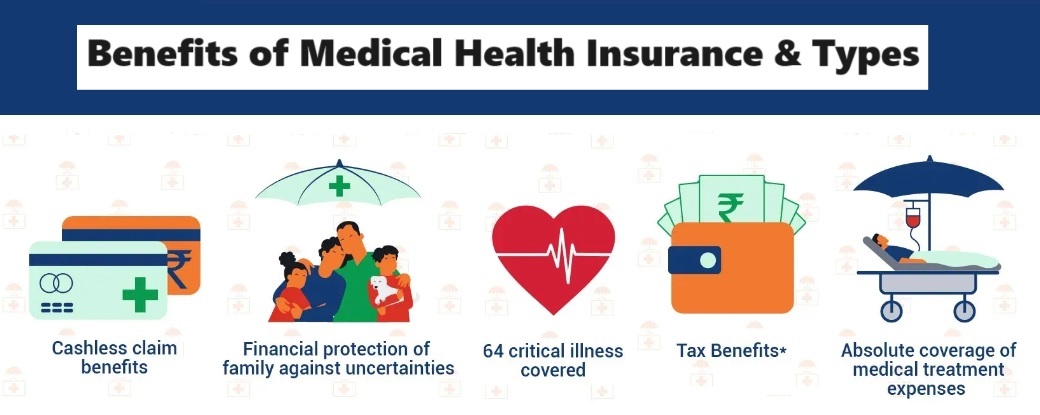

Benefits of Medical Health Insurance & Types

Medical health insurance is a kind of insurance that plays a vital role in providing financial security and access to healthcare services. In this post, we will explore the numerous benefits of having medical health insurance and discuss the various types available. Benefits of Medical Health Insurance: One of the chief advantages of health insurance is the financial safe environment it provides to you. Healthcare costs can be exorbitant, and without insurance, individuals may find themselves in debt. With health insurance, you are safeguarded from the burden of severe medical…

Comparing Individual Health Insurance Options: HMO vs. PPO

Are you searching for the optimal Health Insurance Plan for yourself and your family? If so, you may find yourself at the juncture where you must decide between two highly prevalent options: HMO (Health Maintenance Organization) and PPO (Preferred Provider Organization) Insurance Plans. These two forms of insurance coverage present notable differences that necessitate comprehension before making an informed choice. In this blog, we aim to facilitate your decision-making process by conducting a comparative analysis of these plans, assisting you in identifying the best Individual Health Insurance plan that aligns…