Choosing a portfolio management service is an important decision, as it involves entrusting professionals to manage your investments and financial future. Here are steps to help you select the right portfolio management service:

Define Your Goals and Objectives

Clearly outline your financial goals, risk tolerance, and investment time horizon. Different portfolio management services may specialize in different strategies and asset classes, so understanding your objectives is crucial.

Determine Your Budget

Portfolio management services typically charge fees, often a percentage of assets under management (AUM). Ensure you understand the fee structure and how it aligns with your budget.

Research Potential Providers

Look for portfolio management services that match your investment needs and preferences. You can start by:

Asking for recommendations from trusted sources, such as friends, family, or financial advisors.

Conducting online research to identify firms or professionals with a strong reputation.

Checking if the service is regulated and registered with relevant financial authorities.

Assess Their Expertise and Experience

Evaluate the credentials and experience of the portfolio managers. Look for certifications like CFA (Chartered Financial Analyst) or CFP (Certified Financial Planner) and assess their track record.

Review Their Investment Approach

Understand the investment philosophy and strategy of the portfolio management service. Ensure it aligns with your goals and risk tolerance.

Ask about their asset allocation strategy, risk management techniques, and how they handle market fluctuations.

Request Performance Data

Ask for historical performance data. Pay attention to risk-adjusted returns and consistency in achieving investment objectives.

Inquire about how they’ve performed during different market conditions, including bear markets.

Inquire About Communication and Reporting

Understand how often and through what channels the portfolio management service will communicate with you. Regular updates on your portfolio’s performance are essential.

Ask about the reporting and documentation they provide, including statements and tax-related documents.

Discuss Fees and Costs

Clarify the fee structure, including management fees, performance fees, and any additional charges. Ensure there are no hidden costs.

Compare fees among different portfolio management services to find the best value for your needs.

Check for Transparency

Transparency is crucial. Make sure the service provides clear information about fees, strategies, and potential conflicts of interest.

Ask for References and Client Testimonials

Request references from current or past clients who can provide insights into their experiences with the portfolio management service.

Read the Contract Carefully

Before signing any agreement, carefully review the contract, including terms and conditions, termination clauses, and any penalties for early withdrawal.

Seek Legal and Financial Advice

It’s a good idea to consult with a legal or financial advisor before making a final decision to ensure you fully understand the terms and implications of the portfolio management service.

Start with a Trial Period

If possible, consider starting with a trial period or a smaller investment to assess the service’s performance and your comfort level.

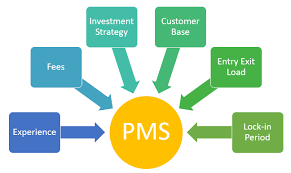

Managing an investment portfolio can be a complex and time-consuming task. Investors often turn to Portfolio Management Services (PMS) to navigate the intricate world of investments while aiming for optimal returns and risk mitigation. This guide will walk you through the crucial steps in selecting a PMS that aligns with your financial goals and preferences.

Understanding Portfolio Management Services (PMS)

Portfolio Management Services, or PMS, are specialised investment services offered by financial institutions and wealth management companies. These services are primarily designed for high-net-worth individuals and institutional investors. The primary objective of PMS is to create and manage a diversified investment portfolio tailored to the client’s financial goals and risk tolerance.

Step 1: Define Your Investment Objectives

The first and most critical step in choosing a PMS is defining your investment objectives. What are your financial goals? Are you aiming for long-term wealth accumulation, regular income, or capital preservation? Understanding your investment goals will provide a roadmap for selecting a PMS that best suits your needs.

Step 2: Assess Your Risk Tolerance

Risk tolerance is a fundamental factor in portfolio management. Different PMS providers offer portfolios with varying risk profiles. To assess your risk tolerance, consider factors such as your age, financial stability, investment experience, and willingness to accept fluctuations in the value of your portfolio. This assessment will guide you in selecting a PMS that aligns with your risk appetite.

Step 3: Research PMS Providers

Once you’ve established your investment objectives and risk tolerance, it’s time to research PMS providers. Look for companies with a solid track record, experienced fund managers, and a reputable presence in the market. Consider the following factors:

Range of Services: Evaluate the range of services offered by each PMS provider. Some may specialise in specific asset classes, investment styles, or strategies. Ensure their services align with your investment goals.

Minimum Investment Requirements: Check the minimum investment requirements set by PMS providers. Ensure they are within your budget and financial capacity.

Fee Structures: Understand the fee structure associated with each PMS provider. Fees can vary significantly and may include management fees, performance fees, and other charges. Evaluate how these fees will impact your returns over time and ensure they are reasonable, given the services provided.

Step 4: Evaluate Performance

Review the historical performance of the PMS provider’s portfolios. While past performance does not guarantee future results, it can provide insights into the manager’s expertise and ability to navigate different market conditions. Analyse returns over various market cycles to assess their performance under different economic scenarios.

Step 5: Understand the Investment Approach

Each PMS provider follows a distinct investment approach and philosophy. Some may focus on value investing, while others prioritise growth or income generation. Understanding the provider’s investment philosophy and strategy is crucial to ensure it aligns with your investment goals and preferences.

Step 6: Assess Costs and Fees

Examine the fee structure of the PMS provider in detail. Costs and fees can have a significant impact on your overall returns. Ensure that you fully understand all fees associated with the PMS, including management fees, performance fees, and any other charges.

Step 7: Inquire About Customisation

Some PMS providers offer the option to customise your portfolio to align with your preferences and requirements. If customization is important to you, inquire about this option and ensure it’s available within the PMS you are considering.

Step 8: Check Regulatory Compliance

Verify that the PMS provider is registered with the appropriate regulatory authorities. Regulatory compliance ensures that your investments are managed transparently and accountable, providing you with added peace of mind.

Step 9: Review the Service Agreement

Carefully review the service agreement provided by the PMS provider. Pay close attention to the terms and conditions, including the duration of the agreement, termination clauses, and any restrictions on withdrawals or changes to your portfolio.

Step 10: Seek Recommendations and References

Feel free to seek recommendations from friends, family members, or financial advisors who have experience with PMS providers. Additionally, ask the PMS provider for references from existing clients. Contact these references to gain insights into their experiences and satisfaction with the service.

Step 11: Ask Questions

Feel free to ask questions during your interactions with the PMS provider. Inquire about their investment process, risk management strategies, and communication practices. A transparent and responsive provider will meet your expectations and provide a positive client experience.

Step 12: Start Small and Monitor

Once you’ve selected a PMS provider, consider starting with a smaller investment to test the waters. It allows you to monitor the performance of your portfolio and stay in communication with your PMS provider to ensure your investment goals are being met.

Step 13: Reevaluate Periodically

Your financial situation and goals may change over time. Periodically reevaluate your PMS provider’s performance and the alignment of their services with your evolving needs. If necessary, consider switching providers to better match your investment goals.

Step 14: Seek Professional Advice

If you need more clarification about choosing a PMS, consider seeking advice from a certified financial advisor. They can provide valuable insights, conduct due diligence on your behalf, and help you make an informed decision.

Conclusion

Choosing a Portfolio Management Service is a significant decision that can significantly impact your financial future. By following these comprehensive steps and conducting thorough research, you can select a PMS provider that aligns with your investment objectives, risk tolerance, and financial goals. Remember that ongoing communication and periodic evaluations are key to a successful and mutually beneficial partnership with your chosen PMS provider.