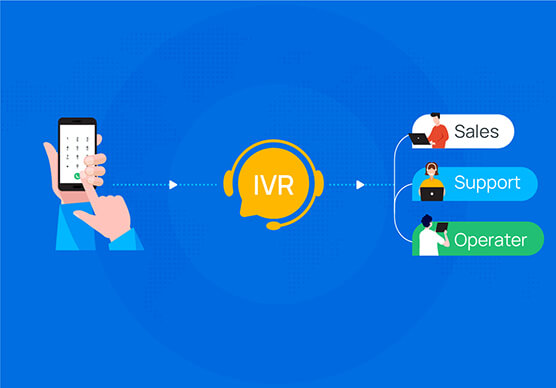

Financial technology (Fintech) has embraced Interactive Voice Response (IVR) technology, revolutionizing how customers and businesses interact with financial services. Customers benefit from efficient, secure, and accessible services offered by fintech companies through IVR systems. This article explores IVR’s importance in the Fintech industry, emphasizing its benefits for businesses and consumers alike.

1. Enhanced Customer Experience:

The enhanced customer experience provided by IVR is one of the primary benefits of IVR in the Fintech sector. In addition to providing financial information and transactions, IVR systems also allow customers to contact customer service representatives at any time, from anywhere. Accessibility is especially important in the Fintech world, where users must have access to services 24/7 and must be able to access them at their convenience.

A Fintech IVR system lets you manage investments, transfer funds, pay bills, and check account balances using simple voice commands or touch-tone inputs. Easy access to financial products empowers customers to manage their finances responsibly and promotes financial literacy.

2. Security and Authentication:

Businesses and customers are concerned about security in the Fintech sector, and IVR plays an important role. The identity of users can be verified with robust authentication methods such as voice recognition, biometrics, and PIN codes incorporated into IVR systems. With this level of security, sensitive financial information and transactions are protected from unauthorized access.

Along with authentication, IVR systems comply with industry regulations and data protection standards, ensuring their success as secure channels for handling financial transactions. Financial transactions are made more secure as a result of IVR systems’ compliance with data protection regulations and standards. As a result, users are more likely to trust Fintech companies.

3. Self-Service Capabilities:

A wide range of financial tasks can be performed independently using IVR systems in the Fintech sector. In addition to checking account balances, reviewing transaction histories, paying bills, setting up recurring payments, and managing investment portfolios, users can also trade stocks through IVR.

Customers save time by using the self-service feature, and customer support teams are able to allocate resources more efficiently. Through fintech companies, customers have access to financial services around the clock, allowing them to manage their finances whenever it is convenient for them.

4. Efficiency and Cost Savings:

The Fintech sector benefits from IVR due to its efficiency and cost-saving capabilities. Through IVR, financial technology companies can streamline their operations and automate routine and high-volume transactions. As a result, human intervention is reduced, operational costs are minimized, and service delivery is sped up.

Customers can make inquiries, transfer balances, apply for loans, and file insurance claims using IVR systems without the involvement of customer service agents. Both businesses and consumers benefit from this automation, as it increases efficiency and lowers overall operational costs.

5. Scalability and Flexibility:

As Fintech businesses expand and adapt to changing customer needs, the sector is dynamic and rapidly evolving. Fintech companies can grow and adapt their services with IVR systems that offer scalability and flexibility.

IVR systems can be easily customized and scaled to accommodate Fintech businesses’ expanding customer base, new products, and entering new markets. Businesses can maintain constant service quality regardless of growth because of this scalability.

6. Technology Integration:

A wide range of financial services are often offered by fintech companies using various technologies. Customer relationship management (CRM) software, mobile apps, and online banking platforms can all be integrated seamlessly with IVR systems. Through this integration, multiple channels can be integrated to provide a seamless customer experience.

Mobile apps allow customers to initiate transactions, and IVRs allow them to complete them. Websites enable customers to access account information, and then make payments over IVRs. As a result of interoperability, Fintech interactions are streamlined and become more convenient for customers.

Get to know more about new Banking System App – Tallyman Axis and get aware of it.

7. Data Analytics and Personalization:

It is possible to collect valuable information on customer preferences and interactions using IVR systems. Fintech companies use this data to improve services and personalize customer experiences.

IVR data can be analyzed to gain insights into customer behavior, preferences, and common issues. Fintech companies benefit from this data-driven approach by identifying trends, catering products to customer needs, and optimizing marketing.

The data collected by IVR systems can also be used to provide personalized service. Loan product recommendations may be made based on customers’ financial history and needs when they call to inquire about loans. Cross-selling and upselling are more likely to occur as a result of this personalization.

8. Adherence to Regulations and Compliance:

Financial transactions and data handling are governed by stringent regulations in the Fintech sector. The IVR system can be configured to adhere to these regulations, ensuring the secure handling of customer data and staying in compliance with government and industry standards.

The Fintech sector often uses IVR systems that are equipped with call monitoring and recording capabilities. Records of customer interactions allow businesses to address legal and regulatory issues, which can be invaluable.

9. Marketing and Communication:

Fintech companies can benefit from IVR systems for marketing and customer service. Outbound IVR can be used for promoting new products, announcing promotions, and providing important information to customers. In addition to keeping customers informed, proactive communication fosters a sense of appreciation, as customers feel that the business pays attention to their needs.

Outbound IVR can be used by Fintech companies to communicate upcoming financial events to customers, to offer personalized investment advice, or to update them regarding regulatory changes. Increased customer loyalty and satisfaction can result from proactive communication.

10. Redundancy and Business Continuity:

Fintech companies must maintain service continuity to remain competitive. In the event of technical issues or disasters, IVR systems offer redundancy and failover capabilities, which ensure that financial transactions and customer service interactions remain operational.

Using IVR systems, you can reroute calls to alternative numbers and locations to avoid service interruptions and maintain customer trust. The redundancy ensures that financial services will remain accessible and reliable even in the event of unexpected disruptions.

Conclusion

Basically, IVR technology in Fintech is important because it helps customers, ensures security, provides self-service, saves money, improves efficiency, and improves customer satisfaction. It’s scalable, flexible, integrates with other technologies, lets you analyze data, personalize it, ensures compliance and regulation, supports marketing and communication, and makes sure you don’t lose your business. A wide range of financial services can be provided efficiently, securely, and conveniently by Fintech companies leveraging IVR systems.