Medical health insurance is a kind of insurance that plays a vital role in providing financial security and access to healthcare services.

In this post, we will explore the numerous benefits of having medical health insurance and discuss the various types available.

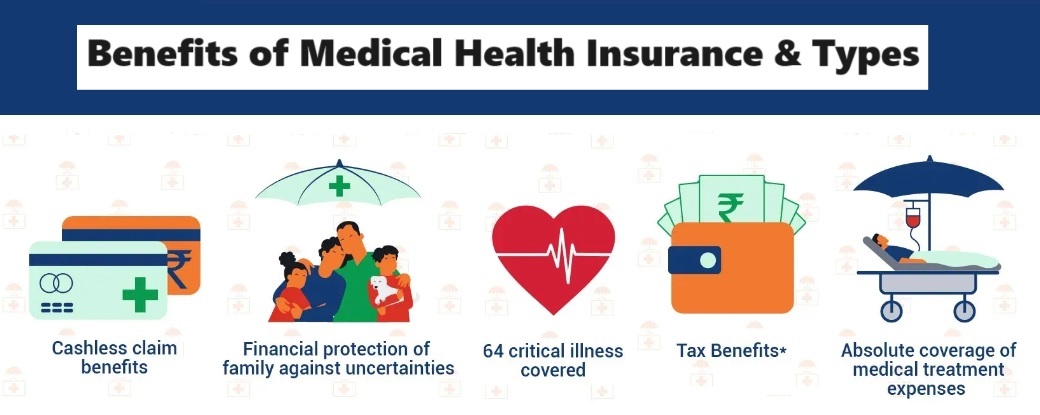

Benefits of Medical Health Insurance:

- Financial Protection

One of the chief advantages of health insurance is the financial safe environment it provides to you. Healthcare costs can be exorbitant, and without insurance, individuals may find themselves in debt.

With health insurance, you are safeguarded from the burden of severe medical expenses. Insurance policies cover only a certain part of your medical bills, lessening down your out-of-pocket expenditure.

- Access to Quality Care

Possessing health insurance plans gives you access to a chain of healthcare professionals, that may include a team of medical practitioners, hospitals, and experts.

This means you can receive quality healthcare services without worrying about the costs involved.

Having insurance also encourages people to seek preventive care and catch health issues early, leading to better health outcomes.

- Preventive Care

Many health insurance plans cover preventive services such as screenings, vaccinations, and wellness checkups at little to no cost.

This encourages people to proactively manage their health, which can prevent the development of serious medical conditions.

- Emergency Care

In case of emergencies, such as accidents or sudden illnesses, medical health insurance makes sure that you can receive immediate and necessary medical attention without even worrying about the expenditure.

In case of an accident, you tend to have a fracture in your bone to which as a result, you would have to look out for the best orthopedic hospital in Delhi NCR.

In such critical circumstances, this acts as a life-saving plan and is well suited for people.

- Choice of Doctors and Hospitals

Depending upon the type of your health insurance plan, you quite often have the flexibility to choose your preferred doctors and hospitals and as mentioned in the above example, you might have to search for an orthopedic doctor in South Delhi.

This allows you to receive care from healthcare professionals you really trust and are absolutely comfortable with.

- Coverage for Chronic Conditions

A lot of individuals suffer from chronic conditions which require ongoing medical attention. Health insurance provides coverage for the management and treatment of these conditions, making it more affordable for the ones who are affected.

- Prescription Drug Coverage

Doctor’s prescription medications can sometimes be really sky-high, leaving you all the more burdened. Health insurance plans often include coverage for prescription drugs, diminishing the out-of-pocket expenses for the required medications.

- Mental Health Services

Mental health is an integral factor of your overall state of being. Many health insurance plans provide coverage for mental health services, that includes both therapy sessions and counseling sessions as well.

- Maternity and Pediatric Care

If you plan to start a family, health insurance can cover the expenditure of prenatal care, childbirth, and pediatric care for your kids.

This makes sure that you along with your family will meet all your proper healthcare needs during these stages of life.

- Dental and Vision Care

Some health insurance plans also offer coverage for dental and vision care, that involves all those routine (or even on a daily basis) checkup sessions, eyeglasses, and other dental services or procedures.

These additional benefits contribute to your overall well-being and health condition.

Now, as we have already explored the benefits that a medical health insurance provides, let us discuss the various types of plans that a health insurance company provides.

Types of Medical Health Insurance:

- Individual Health Insurance

This is one of the most common sorts of health insurance existing in India whose policies provide coverage to one person only.

These plans offer financial protection in case the insured individual requires medical treatment. Premiums are determined based on factors like age, medical history, and the sum insured.

- Family Health Insurance

Family health insurance plans outstretch their coverage to all the family members under a single policy. These policies are cost-effective and easy to use as they cover the medical expenditure of every family member, making it a perfect choice for families.

- Group Health Insurance

Group health insurance is typically offered by employers to their employees. It ensures that employees have access to medical treatment and hospitalization facilities. Group policies are often more affordable due to the collective nature of coverage.

- Senior Citizen Health Insurance

These policies are designed to cater to the specific healthcare needs of senior citizens. Since elderly individuals are more likely to have health issues, these policies offer higher coverage for ailments that stand common in old age, such as diabetes, heart issues, and so on.

- Maternity Health Insurance

Maternity health insurance plans involve all the costs that are in relation with pregnancy and childbirth and such policies also provide coverage for the newborn baby until he or she attains a certain age.

- Critical Illness Cover

The policies concerning critical illnesses offer a lump-sum payment upon diagnosis of certain life-threatening conditions like stroke, cancer, heart attacks, etc.

This money can be utilized for treatment or other financial needs during recovery.

- Personal Accident Insurance

Personal accident insurance provides coverage in case of accidental injuries, disabilities or death. It can be a standalone policy or a rider to other health insurance plans.

- Hospital Cash Insurance

Hospital cash insurance provides a daily allowance for the duration of hospitalization. This can help in covering expenditures such as room rent, transportation, and food during hospital stays.

- Government Health Schemes

The Indian government has introduced several health insurance schemes, such as Ayushman Bharat, that aims to provide healthcare coverage to economically weaker sections of the society.

- Preventive Healthcare Plans

Some insurance companies offer preventive plans that can cover the costs of routine health checkups, vaccination sessions, and other related precautionary measures.

Conclusion:

To sum up, the diverse types of health insurance plans in India cater to a wide range of healthcare needs. Selecting the right plan depends on certain factors.

As healthcare expenses continue to increase, having adequate health insurance is crucial for financial security and mental peace. It is always necessary to carefully evaluate your options and select a plan wisely.