Income tax is a fundamental component of a modern tax system, playing a pivotal role in funding government operations and public services. It is a progressive tax imposed on individuals and entities’ income, with rates varying depending on the level of earnings. The concept of taxing income dates back centuries, but it gained prominence in the early 20th century.

Income tax serves multiple purposes. Firstly, it finances government activities, such as infrastructure development, healthcare, education, and national defense. Secondly, it promotes income redistribution, as higher earners typically face higher tax rates, helping bridge economic disparities. Additionally, it incentivizes economic behavior by offering deductions, credits, and incentives for specific activities, like homeownership or green energy investments.

The complexity of income tax systems worldwide often leads to debates and reforms. Tax laws can be intricate, with frequent changes and amendments. Compliance can be challenging, requiring individuals and businesses to maintain accurate records and navigate a maze of regulations. Governments also use income tax as a tool to stimulate or slow down economic growth, adjusting rates accordingly.

Controversies surrounding income tax range from debates on the fairness of progressive tax structures to discussions about tax evasion and avoidance. Tax authorities continue to grapple with issues related to offshore tax havens and the digital economy’s taxation. The debate on what constitutes a fair and efficient income tax system persists, making it a central theme in political and economic discussions globally.

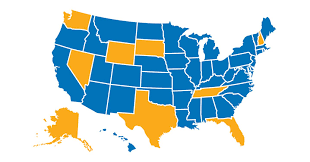

Ten U.S. states have chosen to completely forgo collecting income tax from their residents, and instead, rely on alternative revenue sources to fund their government operations. These states are often referred to as “income tax-free states,” and they attract individuals and businesses seeking to reduce their tax burdens. Let’s explore these 10 states and understand why they’ve made the bold decision to eliminate income tax.

- Alaska: Alaska doesn’t impose state income tax or a statewide sales tax. Instead, it relies on revenue from its vast natural resources, such as oil, to fund government programs. Residents receive an annual dividend from the Alaska Permanent Fund, funded by oil revenues.

- Florida: Known for its beautiful weather, Florida is a popular destination for retirees and entrepreneurs. The lack of state income tax helps to draw individuals seeking to keep more of their hard-earned money.

- Nevada: Nevada sustains its government through tourism, gambling, and sales tax. The absence of state income tax is particularly appealing to those who work in the entertainment and hospitality industries in Las Vegas.

- South Dakota: The Mount Rushmore State avoids income tax by relying heavily on sales and use taxes. The lack of income tax appeals to both businesses and residents.

- Texas: Texas has a robust economy and attracts businesses with its business-friendly policies and the absence of state income tax. Residents benefit from the state’s revenue derived from sales taxes and oil production.

- Washington: Washington generates substantial revenue through sales tax, business taxes, and other means, allowing it to avoid income tax. Tech companies in Seattle, such as Amazon and Microsoft, benefit from this tax structure.

- Wyoming: Like Alaska, Wyoming benefits from its rich energy resources and doesn’t impose state income tax. The state’s budget is primarily funded through mining and drilling.

- New Hampshire: While New Hampshire doesn’t tax earned income, it does impose a tax on dividends and interest. This state appeals to individuals looking for tax relief and the charm of New England.

- Tennessee: Tennessee doesn’t levy a state income tax on wages but does tax investment income. It has attracted retirees and young professionals alike with its favorable tax structure and vibrant cities.

- New Hampshire: While New Hampshire doesn’t tax earned income, it does impose a tax on dividends and interest. This state appeals to individuals looking for tax relief and the charm of New England.

Benefits of income tax

Income tax, a critical source of revenue for governments worldwide, offers a multitude of benefits that contribute to the economic well-being and stability of a nation. Here are some key advantages of income tax:

- Funding Public Services: Income tax revenue supports essential public services such as healthcare, education, infrastructure, and national defense. These services benefit all citizens, ensuring a higher quality of life.

- Wealth Redistribution: Progressive income tax systems can help reduce income inequality by taxing the wealthy at higher rates. This redistribution of wealth can help create a fairer society.

- Economic Stability: Income tax revenue provides governments with a consistent and stable source of income, reducing their reliance on volatile sources like tariffs and sales taxes. This stability can help buffer economic downturns.

- Investment in Infrastructure: Governments can allocate income tax revenue toward infrastructure projects, stimulating economic growth, creating jobs, and improving the overall standard of living.

- Social Welfare Programs: Income tax funds social safety nets, including unemployment benefits and welfare programs, which provide a safety cushion for those in need.

- Incentive for Economic Growth: Well-designed tax incentives can encourage investment in business expansion and innovation, driving economic growth.

- National Security: Income tax supports national security efforts, including military funding and law enforcement, ensuring the safety and security of a nation.

- International Relations: A robust income tax system enhances a country’s reputation and standing in the global community by demonstrating its financial stability and commitment to international obligations.

- Environmental Initiatives: Tax revenue can be directed toward environmental conservation and renewable energy projects, helping to combat climate change and preserve the environment.

- Economic Planning: Income tax data can be crucial for policymakers in making informed decisions about budget allocation, economic planning, and fiscal policies.

In summary, income tax serves as a vital instrument for governments to fund public services, promote economic stability, reduce income inequality, and support the well-being of their citizens. When structured wisely, income tax systems can help create a more equitable, prosperous, and secure society.

These income tax-free states implement various strategies to cover the budgetary gaps left by the absence of income tax. Some rely heavily on sales and use taxes, while others leverage their abundant natural resources or tourism industries. As a result, these states often find themselves in competition with one another to attract residents and businesses seeking tax advantages.

It’s important to note that while these states don’t have a state income tax, they may still have local income taxes, property taxes, or other forms of taxation. Therefore, individuals and businesses considering relocating to these states should carefully assess the overall tax burden and the specific tax implications of their situation.

In conclusion, these ten states with no income tax have strategically chosen alternative revenue sources to fund their governments while providing an attractive financial landscape for their residents and businesses. This approach has not only led to population growth but has also fueled economic development in various sectors, making these states appealing destinations for those looking to maximize their financial well-being.