Managing payroll can be a challenging task, especially for small business owners, freelancers, and entrepreneurs. A free paycheck generator can make the process easier by allowing you to create accurate pay stubs quickly and efficiently. However, with so many options available, choosing the right one for your business can be overwhelming. This guide will help you understand what to look for in a free paycheck generator to ensure compliance, accuracy, and ease of use.

Why You Need a Paycheck Generator

A paycheck generator free of charge is a valuable tool for businesses of all sizes. It helps you:

- Generate professional pay stubs with essential details.

- Keep track of payroll records for tax purposes.

- Ensure employees receive correct and timely payments.

- Stay compliant with tax regulations.

- Save time compared to manual calculations.

Who Should Use a Free Paycheck Generator?

Small Business Owners

If you run a small business and don’t have a dedicated payroll department, a free paycheck generator can simplify payroll processing and ensure accurate documentation.

Freelancers and Independent Contractors

Self-employed individuals need pay stubs for financial transactions, such as applying for loans or renting apartments. A paycheck generator helps create a proof of income easily.

Startup Companies

New businesses operating on a tight budget can benefit from a free paycheck generator to manage payroll costs efficiently.

Employers with Remote Teams

Companies with remote or contract-based employees need a reliable way to issue pay stubs. A paycheck generator free of cost can streamline this process.

Key Features to Look for in a Free Paycheck Generator

When selecting a free paycheck generator, consider the following features to ensure it meets your business needs:

1. Ease of Use

Look for a tool with a simple and user-friendly interface. You should be able to enter employee details and generate pay stubs without technical knowledge.

2. Customization Options

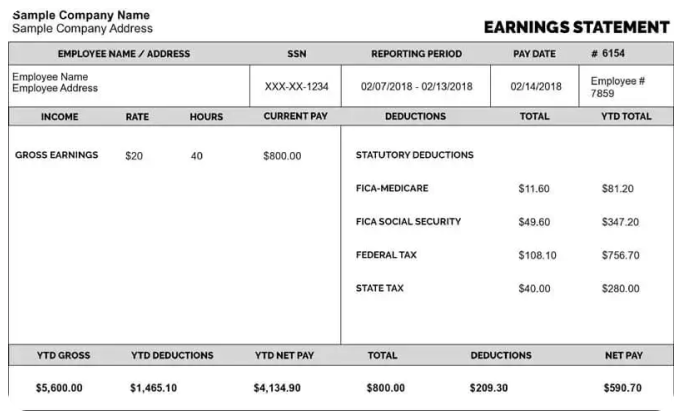

A good paycheck generator allows customization, such as adding company logos, specifying deductions, and including additional information like overtime pay.

3. Automatic Tax Calculations

Some paycheck generators free of charge include automated tax calculations, ensuring compliance with state and federal tax laws.

4. Security and Privacy

Since payroll information is sensitive, choose a generator that offers secure data encryption and protection against cyber threats.

5. Multiple Payment Options

Ensure the generator supports different payment structures such as hourly wages, salaries, bonuses, and commissions.

6. Download and Print Options

Look for a tool that allows you to download, print, or email pay stubs for record-keeping.

7. Integration with Accounting Software

Some free paycheck generators integrate with accounting systems like QuickBooks or FreshBooks, making it easier to track payroll expenses.

8. Compliance with Payroll Laws

The best paycheck generator-free option should comply with tax laws and payroll regulations to avoid legal issues.

Steps to Choose the Best Free Paycheck Generator

Step 1: Define Your Payroll Needs

Consider the size of your workforce, payment frequency, and tax requirements before selecting a tool.

Step 2: Research Available Options

Compare different free paycheck generators online, checking reviews and ratings from other users.

Step 3: Test the Features

Use trial versions or demo tools to evaluate the interface, customization options, and accuracy of calculations.

Step 4: Check Security Features

Ensure the generator uses encryption and secure data storage to protect employee information.

Step 5: Verify Compliance with Payroll Laws

Choose a generator that follows state and federal payroll regulations, avoiding any potential legal issues.

Step 6: Look for Customer Support

Even with a free tool, having access to customer support or FAQs can be helpful if you encounter issues.

Popular Free Paycheck Generators

Here are some commonly used free paycheck generators:

- Paycheck Stub Online – Offers customizable pay stub templates and tax calculations.

- 123PayStubs – Allows easy creation of professional pay stubs with multiple formats.

- Check Stub Maker – Simple, user-friendly interface with basic pay stub generation.

- PayStubs.net – Provides downloadable pay stubs with tax calculations.

- FormPros Paycheck Generator – Includes compliance checks and printable pay stubs.

Common Mistakes to Avoid When Using a Free Paycheck Generator

1. Entering Incorrect Information

Always double-check employee details, tax deductions, and salary information to prevent errors.

2. Not Verifying Tax Compliance

Ensure the generator calculates state and federal taxes correctly to avoid penalties.

3. Relying Only on Free Tools for Payroll Management

While a paycheck generator free of charge is helpful, it may not replace full payroll software if your business grows.

4. Ignoring Security Features

Using an unsecured generator could risk exposing sensitive payroll data. Always choose a secure platform.

Conclusion

Choosing the right free paycheck generator for your business depends on your specific needs, ease of use, and compliance with tax regulations. By considering essential features like customization, security, and automation, you can streamline payroll processing while ensuring accuracy. Whether you’re a small business owner, freelancer, or startup, the right paycheck generator can save you time and effort while keeping your payroll organized and professional.

Related Articles

Access Your Pay Information Using eStub in 2025

TruBridge Paystub Not Showing? Here’s What to Do

Why Employer Should Use a Free Payroll Check Stubs Template?