In today’s fast-paced world, financial literacy is more critical than ever. Understanding the basics of loans and interest calculations can empower you to make informed decisions regarding borrowing and repayment. One of the essential tools available for those seeking clarity on these topics is the simple interest loan calculator. This powerful yet straightforward tool can remove much of the guesswork involved in financial planning. In this article, we will delve deeper into how a simple interest loan calculator works, its benefits, and the role of flexi loan calculators in financial planning.

Understanding Simple Interest

Simple interest is a quick and uncomplicated method for calculating the interest charged on a loan. Unlike compound interest, which calculates interest on both the initial principal and the accumulated interest, simple interest is only calculated on the original principal amount. This makes it easier to comprehend and calculate, especially when using a simple interest loan calculator.

How Simple Interest Works

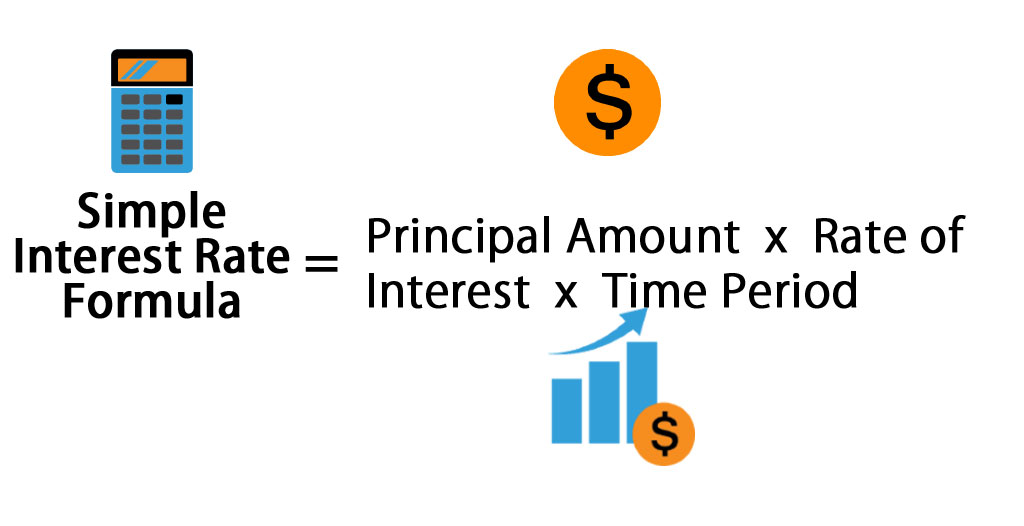

The formula for calculating simple interest is straightforward:

\[ \text{Simple Interest (SI)} = P \times R \times T \]

Where:

– \( P \) is the principal amount.

– \( R \) is the rate of interest per annum.

– \( T \) is the time duration (in years) over which the loan is taken.

Understanding this formula enables borrowers to estimate the total interest they will need to pay over the loan period.

The Role of a Simple Interest Loan Calculator

A simple interest loan calculator is an online tool or software that simplifies the process of calculating simple interest on loans. By inputting key variables such as the principal amount, interest rate, and loan duration, borrowers can quickly determine their total interest obligation and monthly repayment amounts. This tool is vital for several reasons:

– Time-Saving: It saves users from the hassle of manually plugging numbers into the formula, reducing potential calculation errors.

– Financial Planning: By showing the complete payment schedule, a simple interest loan calculator helps individuals plan their finances better by understanding the distribution of principal and interest.

– Comparison: Users can quickly compare various loan options by changing input variables, helping them choose the most favorable terms.

Steps to Use a Simple Interest Loan Calculator

Using a simple interest loan calculator involves just a few simple steps:

1. Input Principal Amount: Enter the total loan amount you wish to borrow.

2. Interest Rate Entry: Fill in the interest rate offered by the lender.

3. Loan Duration: Specify the term for which the loan will be borrowed, generally in years.

4. Calculate: Click on the calculate button to instantly receive details on the interest payable and monthly installments.

Distinguishing Between Simple and Flexi Loan Calculators

While simple interest loan calculators focus on fixed principal and interest calculations, a flexi loan calculator, as suggested by its name, offers more flexibility. Flexi loans, often offered as personal or business loans, allow the borrower to withdraw funds as needed, within an approved limit, and pay interest solely on the amount utilized.

Features of a Flexi Loan Calculator

1. Flexible Withdrawals: Flexi loans enable users to calculate repayment amounts based on varying principal withdrawals over time.

2. Interest Calculation: A flexi loan calculator helps estimate interest based on fluctuating outstanding balances, rather than a fixed principal.

3. Partial Prepayment Benefits: Borrowers can gauge the impact of partial prepayments, which might reduce future interest payments.

Importance of Choosing the Right Tool

Selecting the appropriate calculator depends on your financial scenario. While simple interest loan calculators are ideal for fixed loans, those considering a flexible borrowing structure might benefit more from a flexi loan calculator. Both tools provide insights into interest and repayment amounts but cater to different loan structures.

Advantages of Using Loan Calculators

1. Financial Literacy: Engaging with loan calculators promotes understanding of personal finance and loan mechanics.

2. Informed Decision-Making: These tools facilitate comparison and analysis of various loan offers, ensuring that you select the best terms.

3. Budgeting Assistance: By comprehending your potential repayments, you can better budget your monthly expenses, preventing financial stress.

4. Scenario Analysis: Whether planning for a potential rate change or exploring different loan durations, calculators help model various financial scenarios.

Conclusion

In conclusion, a simple interest loan calculator is an indispensable tool for anyone contemplating taking a loan. It simplifies the process of understanding interest calculations and monthly repayments, ultimately aiding in effective financial management. Pairing the use of such tools with a comprehensive understanding of loan types — like those offered through a flexi loan calculator — equips borrowers to be savvy decision-makers. As technology continues to evolve, leveraging these calculators can provide clarity in personal finance, ultimately leading to more confident and informed borrowing decisions. Whether you’re opting for a straightforward loan or contemplating a flexible borrowing arrangement, calculators offer the insights needed to navigate the financial landscape with ease and precision.